4 Years of Brexit

"We miss Great Britain as an important partner"

Four years ago today, on January 31, 2020, the United Kingdom left the EU. On the occasion of the anniversary, VDA expert Dr. Karoline Kampermann explains in an interview about the extent to which Brexit has changed economic cooperation between the UK and the EU and what that means for the German automotive industry.

Four years ago today, on January 31, 2020, the United Kingdom left the EU. On the occasion of the anniversary, VDA expert Dr. Karoline Kampermann explains in an interview about the extent to which Brexit has changed economic cooperation between the UK and the EU and what that means for the German automotive industry.

January 31, 2024

As a result of Brexit, British economic performance has deteriorated enormously. What does the Brexit balance look like for Germany and Europe so far?

Overall, Brexit has left its mark both politically and economically. After more than 40 years in the EU, we miss Great Britain as an important partner with whom Germany was often able to pull together politically. This partner is also missing from an economic perspective in the internal market and the customs union, from which Great Britain left on January 1, 2021. The British economy is still suffering massively from Brexit and the decision continues to divide the country politically.

What made matters worse was that Brexit coincided with the COVID pandemic. Production losses due to lockdowns and problems with the procurement of input materials and raw materials led to disruptions in the supply chains. Today there is a lot of additional bureaucracy that companies have to comply with on the UK and EU side. In summary, Brexit remains a major challenge and both sides of the English Channel continue to struggle with its aftermath.

You state that the German automotive industry misses the United Kingdom as an important partner in the EU. In which areas specifically?

We have a similar understanding of the value of free and fair trade. For the automotive industry in Germany, with an export share of around 75%, it is essential to conclude free trade agreements with third countries and have access to other markets that is as unhindered as possible. Because of its history, Britain has always been a strong free-trading nation. In solidarity with other liberal-oriented member states, such as the Netherlands, Denmark, Sweden and often Germany, the UK has campaigned for open markets, better trade relations and the reduction of trade barriers. Especially at the current time, when alliances and covenants are playing a very important new role due to geopolitical risks, it is all the more regrettable that Great Britain is no longer a member of the EU. Strengthening and deepening the common internal market has also always been an important British concern that we shared.

What particular effects does Brexit have on the German automotive industry?

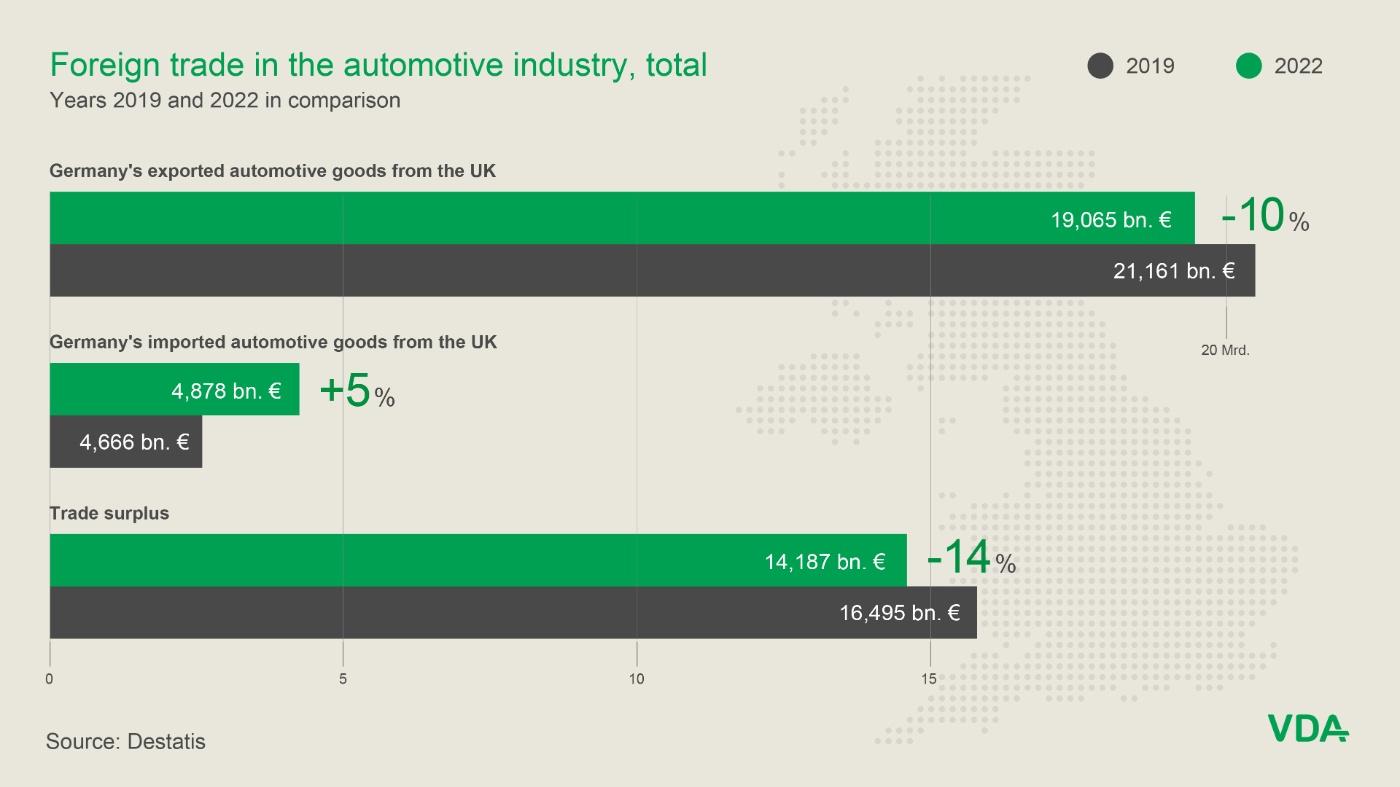

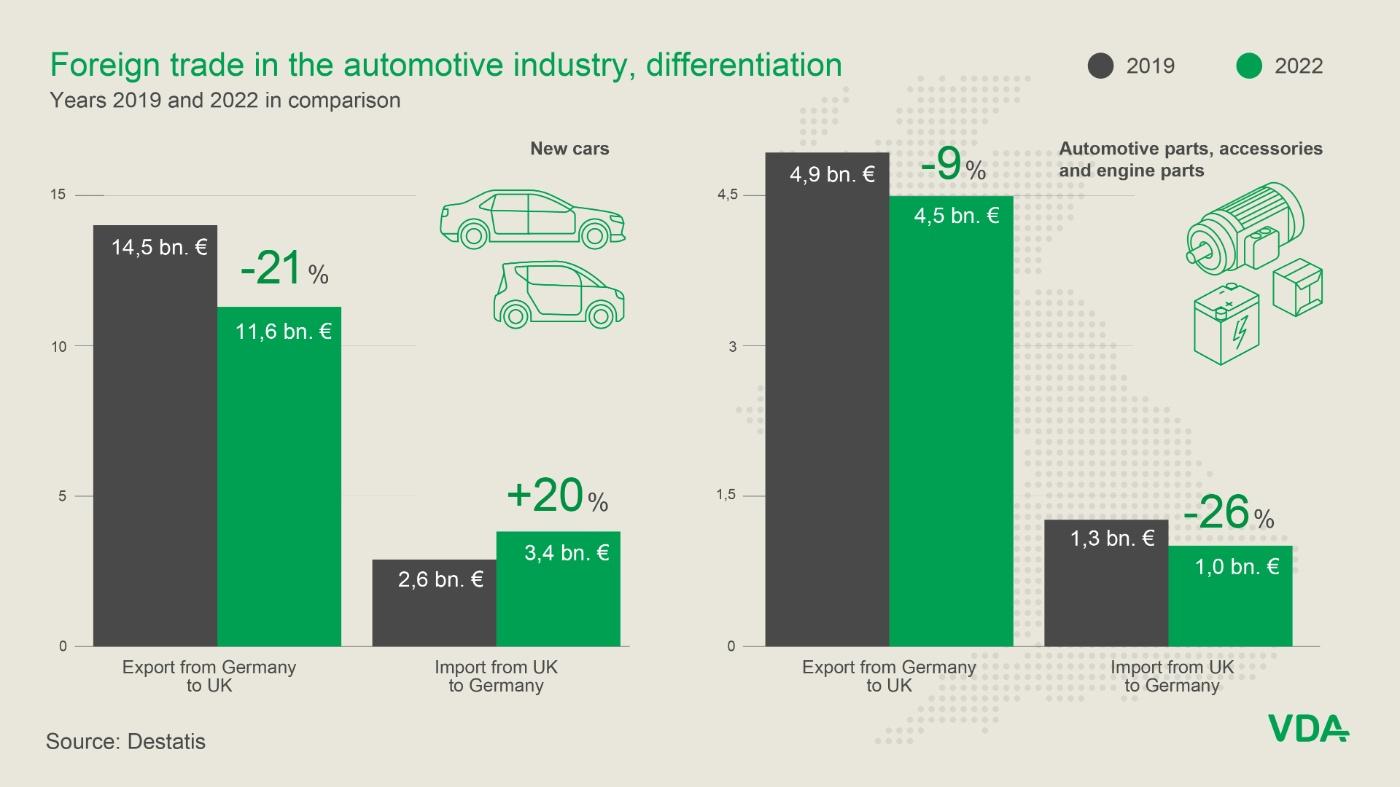

The UK market is still very important for German car manufacturers and suppliers. Here are some figures from the first half of 2023: Germany had a trade surplus of €8.6bn concerning automotive goods with the UK. German manufacturers exported 65,000 electric cars from Germany to the UK - making the UK the most important export country, ahead of the USA. In total, this is 31% of all passenger car exports from German manufacturers.

The fact is: the absolute figures in trade with the UK have already fallen significantly since Brexit. The value chains of manufacturers and suppliers are strongly developed across the English Channel. This also applies to British suppliers. Sometimes automotive parts cross the Channel several times before the vehicle is completed. This shows how closely the British factories are connected to factories in the EU27. We have long feared that there would be a hard Brexit, which would have been associated with newly introduced high tariffs - that would be the worst case, and not just for our industry. Fortunately, on Christmas Eve 2020, just before the end of the transition period, the Trade and Cooperation Agreement between the European Union and the United Kingdom (TCA) was agreed. This meant that the immediate threat of tariffs was off the table.

And what about the bureaucracy?

Due to Great Britain's withdrawal from the customs union, imported and exported goods must be declared to customs and customs formalities must be complied with. Many declarations and evidence must be filled out and carried or provided by the freight forwarders. This additional bureaucracy represents a significant expenditure of time and money and places a heavy burden on companies. In addition, there is the end of the free movement of people between the EU and the United Kingdom. Although the TCA also provides certain relief here, there are still restrictions and approval requirements when providing services in the United Kingdom, for example. None of this would be necessary without Brexit.

Let's stay on the topic of tariffs. On December 21, 2023, after intensive discussions, there was good news: Shortly after the Council of the EU approved the extension of the current so-called rules of origin for electric vehicles until the end of 2026, the EU-UK Partnership Council set up under the TCA also voted in favor of this decision. Before we delve deeper, what exactly are these rules of origin?

Rules of origin often contain very complex requirements and are an important part of free trade agreements. The rules of origin determine the conditions under which a good can benefit from the advantages of the free trade agreement. If the conditions are met, the customs exemption agreed in the agreement applies. To put it simply, it ensures that goods are only benefited if they generate a certain amount of added value within the contracting states.

What does this mean specifically for electric vehicles in trade with the UK?

Für Elektrofahrzeuge gestalten sich die im TCA vorgesehenen Ursprungsregeln nicht zuletzt aufgrund der besonderen Berücksichtigung des Ursprungs der Batterien sowie der Batterievormaterialien sehr komplex und herausfordernd. Zudem sah das TCA zunächst eine Verschärfung der Anforderungen an die europäische beziehungsweise britische Wertschöpfung bei Elektrofahrzeugen in drei Phasen vor. Ziel der Europäischen Kommission war es, für die europäischen Batteriehersteller und die Automobil- und Chemieindustrie über die Ursprungsregeln einen stärkeren Anreiz für den Aufbau der europäischen Batteriewertschöpfungskette zu schaffen.

Die deutschen Automobilunternehmen haben sich dem weiteren Auf- und Ausbau eines europäischen Wertschöpfungsnetzwerks für Batterien verschrieben. Gleichzeitig war der europäischer Batteriemarkt in den letzten Jahren von vielen Unsicherheiten geprägt, wie Covid-19, dem russischen Angriffskrieg auf die Ukraine, hohen Energiekosten, logistischen Schwierigkeiten und weiteren Herausforderungen. Diese Unsicherheiten haben die Entwicklungen stark beeinflusst und prägen den Batteriemarkt auch weiterhin. Somit wurde im letzten Jahr immer deutlicher, dass die Bedarfe der Automobilindustrie von europäischen Batterieprojekten bislang nicht gedeckt werden können. Somit hätten die ab 2024 verschärften Ursprungsregeln nicht erfüllt werden können – die unmittelbare Folge wären Zölle auf den Handel mit Elektrofahrzeugen zwischen der EU und dem Vereinigten Königreich ab dem 1. Januar 2024 gewesen.

The TCA provides the automotive industry with rules of origin for vehicles with combustion engines as well as for the increasingly electrified hybrid and fully electric vehicles. It initially comprised two phases with product-specific transition rules:

- Phase I for the period from January 1, 2021 until December 31, 2023 and

- Phase II from 2024 until December 31, 2026). The second phase contained tightened requirements for the rules of origin for battery cells and battery packs. This phase has now been suspended.

- Rather, from January 1, 2027 (Phase III, final rules), the stricter final rules of origin planned will come into force immediately.

To what extent has the VDA been committed to preventing the tariffs from coming into force?

The VDA was very intensively involved in the entire process. We have already emphasized in the negotiations on the TCA that the rules of origin for electromobility must take into account the real circumstances when setting up battery value chains. VDA colleagues from various specialist departments, our committees and numerous other representatives of our OEMs and suppliers pulled together here. In many discussions since then - in close coordination with our members - we have provided figures and data, advocated for an extension of the current rules of origin until 2026 and pointed out the negative effects of tariffs on electric vehicles in trade with the UK. It was therefore right and crucial that the federal government ultimately supported this concern and advocated for the extension of the current rules of origin to the EU Commission and other member states. Everything happened very quickly in December: on December 6th, the European Commission presented a proposal for adapting the TCA. On December 21st, after some negotiations, the Council of Member States finally officially agreed to this proposal. This empowered the Commission to submit this proposal to the EU-UK Partnership Council, which accepted it at the very last minute.

The automobile companies now have three years to implement the recently specified rules. On January 1, 2027, rules of origin with further increased requirements for European value creation for electric vehicles will come into force. A further postponement is excluded. However, there is also a need for further action: It is now important for companies that the European Commission and the UK ensure clarity and legal certainty in the short term regarding important terms such as active cathode material.

What would be the consequences if the extension of the rules of origin had not occurred?

These would not only have been disadvantageous for companies in the automotive industry. What’s not be overlooked: If electric vehicles had been subject to additional tariffs when importing and exporting between the EU and the UK from this year onwards, this would have meant price increases for consumers in many cases. Customs duties would have disadvantaged in particular those customers who decided to switch to e-mobility. This would have been a major setback for the ramp-up of e-mobility and the decarbonization of transport in Europe and the transformation as a whole - and of course it would have put it at a competitive disadvantage compared to Asian competitors.

What further opportunities and risks can we expect from Brexit in the next few years?

The companies in the automotive industry - manufacturers and suppliers - continue to do everything they can to further develop and strengthen battery value chains in Europe in order to sustainably avoid the “Brexit specter” of tariffs in electromobility. In addition, we as the automotive industry remain in close contact with our British partners. The VDA has specifically taken Brexit as an opportunity to set up the UK Germany Automotive Working Group together with the British automobile association SMMT. We are supported by the respective economic ministries in London and Berlin.

The primary goal of this working group is to maintain the existing close relationship in the automotive industry and to provide a platform to discuss issues that concern the automotive industry on both sides with each other and, where appropriate, with the government. In November, at the invitation of SMMT, we had been in London with a delegation from the VDA, members and the Ministry of Economics for a very informative exchange and we are looking forward to a return visit from our British friends in Berlin this year. This is also an offer to our members: If you are interested in the Working Group and an exchange with the UK, please contact us!